1. The November Market Landscape: A Confluence of Crises

As the penultimate month of 2025 progresses, the cryptocurrency market finds itself navigating a veritable “perfect storm” of macroeconomic friction, technical deterioration, and geopolitical instability. Following a euphoric period dubbed “Uptober,” where Bitcoin (BTC) price action flirted with record highs near $126,000, November has introduced a stark and brutal reversal in sentiment. As of mid-November, the premier digital asset has breached the psychological and technical fortress of $90,000, trading at valuation levels not witnessed since April 2025. This report provides an exhaustive, expert-level dissection of the multifaceted vectors driving this downturn, ranging from the aftershocks of the longest U.S. government shutdown in history to the structural capitulation of mining syndicates and the looming specter of the “AI Bubble.”

The current market environment is defined by extreme volatility and a palpable sense of disorientation among institutional allocators. The collapse through the $100,000 support level earlier in the month served as the initial tremor, but the subsequent failure to defend $90,000 has confirmed a transition into a defensive, risk-off regime. This correction has erased nearly all gains accrued throughout 2025, forcing a repricing of risk across the entire digital asset spectrum.5 The analysis that follows dissects these trends through on-chain metrics, derivatives market positioning, and macroeconomic data to provide a comprehensive forecast for Bitcoin’s expected closing price on November 30, 2025.

1.1 The Post-Shutdown Data Vacuum and Liquidity Shock

To understand the severity of Bitcoin’s current price action, one must first contextualize the macroeconomic environment created by the recently concluded U.S. government shutdown. Lasting 43 days, this shutdown stands as the longest in history, and its cessation on November 12, 2025, did not immediately restore market equilibrium. Instead, it unleashed a chaotic “data dump” into a market suffering from a liquidity vacuum.

During the 43-day lapse, the Bureau of Labor Statistics (BLS), the Bureau of Economic Analysis (BEA), and the Census Bureau ceased the publication of critical economic indicators, including inflation (CPI/PCE) and employment data. This created a “black hole” for the Federal Reserve; policymakers were effectively flying blind, unable to calibrate interest rate policy against real-time economic performance. In the absence of data, speculative markets—including crypto—optimistically priced in a 95% probability of a December interest rate cut, assuming the shutdown would damage the economy sufficiently to warrant monetary easing.

However, as government operations resumed and the backlog of data began to hit the wires, this narrative unraveled violently. The delayed data indicated that the economy remained hotter than anticipated, capable of financing debt through nominal GDP expansion rather than requiring immediate rate cuts. Consequently, the probability of a December rate cut collapsed from 95% to roughly 46% within days. This drastic repricing of the yield curve sucked liquidity out of high-beta, non-yielding assets. Bitcoin, which serves as the most liquidity-sensitive barometer in modern finance, absorbed this impact most severely, leading to the sharp sell-off observed in the second week of November.

1.2 Global Geopolitical Friction and the “Risk-Off” Contagion

The liquidity crisis in the United States is being exacerbated by a deterioration in the global risk environment. Financial stress is not contained within American borders; Asian markets have experienced significant synchronized declines that have spilled over into the 24/7 crypto markets. Japan’s Nikkei index shed 3.2% and South Korea’s KOSPI fell 3.3% in mid-November, driven by renewed trade tensions and concerns regarding the durability of the technology sector.

This global “risk-off” sentiment is critical because Bitcoin has increasingly correlated with global equity liquidity rather than acting as an uncorrelated hedge. The “liquidity reset” described by digital asset experts suggests that the sell-off triggered on October 10—dubbed “Crypto Black Friday”—was a mechanical deleveraging event. When traditional portfolios bleed due to instability in the Chinese property sector or weakness in the Yen, Bitcoin is often the first asset sold to raise cash for margin calls, largely due to its instant settlement and deep liquidity compared to other asset classes.

Furthermore, the geopolitical landscape remains fraught with tension. Analysts have noted that while the immediate threat of U.S.-China trade wars caused the initial October sell-off, the lingering uncertainty continues to suppress the appetite for speculative assets. The market is currently pricing in a “wait and see” approach, effectively sidelining the capital that fueled the ETF inflows earlier in the year.

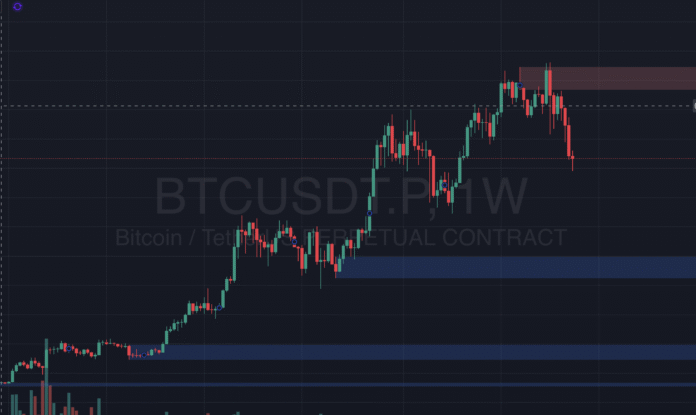

2. Technical Analysis: The Structural Breakdown

From a pure charting perspective, the damage inflicted on Bitcoin’s market structure in November 2025 is profound. The transition from “Uptober” euphoria to “November Nightmare” has technically invalidated several bullish theses, leaving price action dictated by bearish momentum indicators and critical support failures.

2.1 The “Death Cross”: Lagging Indicator or Harbinger of Doom?

A focal point of technical debate in mid-November is the formation of a “Death Cross” on the daily chart. This pattern occurs when the short-term 50-day moving average (MA) crosses below the long-term 200-day moving average, a signal widely interpreted by traditional finance as the confirmation of a bear market.

Table 1: Moving Average Configuration (As of Nov 18, 2025)

| Indicator | Value (USD) | Trend Direction | Market Implication |

| Price (Spot) | ~$92,036 | Bearish | Trading below all major MAs |

| 50-Day MA | $110,880 | Downward | Short-term momentum has collapsed |

| 100-Day MA | $112,769 | Downward | Intermediate trend is negative |

| 200-Day MA | $103,960 | Neutral/Flat | Long-term bull trend invalidated |

| Signal | 50D < 200D | Death Cross | Major Sell Signal / Capitulation |

While the media sensationalizes the Death Cross as a catastrophic signal, sophisticated analysis requires a more nuanced view. Historical data indicates that in choppy, sideways markets (characteristics of the 2023-2025 cycle), the Death Cross is often a lagging indicator. By the time the cross mathematically confirms, the majority of the price depreciation has already occurred. Snippets indicate this is the fourth such cross of the current cycle; significantly, every previous instance in this cycle marked a local bottom rather than the commencement of a new, prolonged downtrend.

However, the context of this specific cross is concerning. Unlike previous crosses which occurred during consolidation, this cross coincides with the loss of the $100,000 psychological level and the breach of the 200-day MA itself. This suggests that while the signal is lagging, the momentum behind the sell-off is structurally significant. The convergence of the 50-day and 200-day MAs near the $104,000 level now creates a massive overhead resistance zone—a “brick wall” that bulls will find difficult to penetrate in the short term.

2.2 The Megaphone Pattern and the $75,000 Target

Adding to the bearish technical outlook is the identification of a “Broadening Top” or “Megaphone Pattern” on the daily chart. This formation is characterized by expanding volatility, creating a series of higher highs and lower lows that resemble a megaphone. It represents a market that is out of control, driven by emotional swings rather than rational accumulation.

The technical implications of a breakdown from this pattern are severe. When Bitcoin slipped below the $100,000 neckline of this formation, it triggered a measured move target to the downside. Bearish technicians project a potential slide toward $75,000, calculated by subtracting the height of the pattern from the breakdown point. This target aligns uncomfortably with deeper volume support zones, suggesting that if the current defense at $90,000-$92,000 fails definitively, the market could enter a freefall toward the mid-$70k region before finding value buyers.

2.3 Support and Resistance Hierarchy

The current price action has established a clear hierarchy of levels that traders are watching. The loss of the $90,000 level was critical because it represented a “high volume node”—a price heavily traded since April. Below this, the market enters a zone of “thin liquidity.”

-

Immediate Resistance ($94,000 – $98,000): The previous support has flipped to resistance. The $98,000 level, in particular, was a staunch defense point last week and will now likely attract short sellers looking to fade any rallies.

-

Major Resistance ($106,000 – $109,000): Described as a “brick wall,” this zone contains the 50-day and 200-day moving averages. A reclaim of this level is required to invalidate the bearish thesis.

-

Critical Support ($83,000 – $84,000): This level corresponds to the 0.382 Fibonacci retracement from the 2022 bottom to the October 2025 high. It is the “line in the sand” for the bull market structure. Losing this would technically confirm a cycle shift.

-

Catastrophic Support ($69,000 – $72,000): The 2024 consolidation zone and previous cycle high. If $83k fails, this is the next logical stopping point.

3. Institutional Flows and the “Hidden” Sellers

While technicals describe what is happening, on-chain analysis and flow data explain why. The narrative of institutional adoption, which drove the early 2025 rally, is currently undergoing a stress test. The market is witnessing a reversal of flows, characterized by ETF redemptions and the unwinding of leveraged corporate strategies.

3.1 The Great ETF Unwind

The launch of Spot Bitcoin ETFs was the primary driver of capital appreciation in Q1 2025. However, these vehicles are bidirectional; they amplify both buying and selling pressure. November has witnessed a mass exodus of capital from these products, signaling a shift in institutional sentiment.

Data reveals that investors pulled approximately $2.9 billion from global crypto ETFs in the first half of November alone.16 This magnitude of outflow rivals the capitulation events seen in February 2025, indicating that the “paper hands” who entered during the October rally are exiting en masse.

-

BlackRock’s iShares Bitcoin Trust (IBIT): As the bellwether for the sector, IBIT has seen significant redemptions, shedding over $1.2 billion in assets in just 17 days.

-

Implications: This reversal signifies that institutional capital is not blindly committed to the “digital gold” thesis. Faced with the reality of “higher for longer” interest rates and delayed Fed cuts, asset managers are reallocating to risk-free Treasuries, which currently offer attractive yields without the volatility of crypto.

3.2 The Crisis of “DATCos” (Digital Asset Treasury Companies)

A critical, yet under-reported, factor exacerbating the November crash is the unraveling of Digital Asset Treasury Companies (DATCos). These are publicly traded firms that, following MicroStrategy’s playbook, leveraged their balance sheets to hold Bitcoin and other digital assets as reserve currencies.

Throughout 2025, these firms poured an estimated $42.7 billion into the crypto market, with over $22 billion deployed in Q3 alone. However, this aggressive accumulation was often funded through convertible notes and other debt instruments. With Bitcoin’s price plummeting 30% from the highs, the Net Asset Value (NAV) of these companies has degraded significantly.

-

Forced Seller Dynamics: Many of these firms are now “underwater” on positions taken during the Q3 highs. Their funding structures and debt covenants may force them to liquidate assets to maintain solvency ratios or cover liabilities. This creates a “forced seller” dynamic that is invisible to retail traders looking only at exchange order books but is highly visible to over-the-counter (OTC) desks.

-

MicroStrategy’s Slowdown: Even the pioneer of this strategy, now rebranded as “Strategy,” has shown signs of cooling. Data indicates they purchased only 4,300 BTC in Q3, the slowest pace in a year. This reduction in relentless buying pressure removes a key floor from the market.

3.3 Whale Distribution and Miner Capitulation

Beyond the corporate treasuries, traditional “Whales” (entities holding >1,000 BTC) are distributing coins at the highest rate since 2021. The number of whale addresses has dropped steadily since the October peak, suggesting that smart money utilized the liquidity of the “Uptober” rally to exit positions.

Furthermore, the supply side is burdened by Miner Capitulation. The economics of mining were drastically altered by the April 2025 halving, which cut block rewards in half. With the price dropping below $94,000—a level considered the break-even point for many inefficient miners—operations are becoming unprofitable.

-

The Sell-Off: Miners have dumped over 71,000 BTC onto exchanges in November to cover operational costs (OPEX) and debt service. This is not discretionary selling; it is a structural necessity. Until the price recovers or difficulty adjusts downward, this steady supply of coins will continue to dampen any attempted rallies.

4. The AI Correlation and the Nvidia Event

In 2025, Bitcoin effectively morphed into a leveraged proxy for the broader technology sector, specifically the Artificial Intelligence theme. Its correlation with the Nasdaq 100 and AI bellwethers has risen to over 80%.11 This linkage explains much of the November downside and highlights the pivotal importance of upcoming corporate earnings.

4.1 The Nvidia Bellwether (November 19, 2025)

The crypto market is currently paralyzed in anticipation of Nvidia’s (NVDA) Q3 fiscal 2026 earnings, scheduled for release after the market close on November 19, 2025. Nvidia has become the single most important stock in the global financial system, surpassing a $4 trillion market cap and dictating risk sentiment across all asset classes.

-

The Guilt by Association: Bitcoin is suffering from “guilt by association.” Investors fear that the AI boom is a bubble akin to the Dot-Com era. If Nvidia misses expectations or provides weak guidance, the “AI Bubble” narrative could burst. Given Bitcoin’s high correlation, a crash in NVDA shares would likely drag Bitcoin down to new lows, potentially testing the $80,000 region.

-

The Options Market Prediction: Options pricing indicates that traders expect a massive move of approximately 7% in Nvidia’s stock price in either direction following the report. A move of this magnitude in a $4 trillion company represents hundreds of billions of dollars in value fluctuation—volatility that will inevitably spill over into the crypto markets.

-

Expectations: Wall Street expects Nvidia to report revenue of roughly $54-55 billion. However, the “whisper numbers” (unofficial expectations) are likely higher. A “beat” that isn’t a “massive beat” could still result in a sell-the-news event, which would be bearish for Bitcoin.

4.2 The Divergence of Capital

There is also a secondary risk: capital concentration. Even if Nvidia reports strong numbers, there is a growing trend of capital fleeing speculative crypto assets to chase the “sure thing” of AI infrastructure. Investors may view AI equities as the superior growth vehicle, siphoning liquidity away from the digital asset ecosystem. This rotation is evident in the disparity between the Nasdaq’s relative resilience (down only 4% in November) compared to Bitcoin’s ~30% plunge.

5. Global Regulatory and Political Currents

While the immediate price action is dominated by liquidity and tech correlations, the regulatory landscape is shifting in ways that could define the long-term trajectory of the asset class. November has brought significant developments in crypto policy, both in the United States and abroad.

5.1 The “Project Crypto” Pivot in the U.S.

Following the government reopening, SEC Chairman Paul Atkins delivered a landmark address on November 12, 2025, outlining a new initiative dubbed “Project Crypto“. This initiative signals a decisive shift away from the “regulation by enforcement” tactics that characterized the previous administration.

-

The New Token Taxonomy: Chairman Atkins proposed a taxonomy based on the Howey Test that classifies digital assets into four distinct categories:

- Digital Commodities/Network Tokens: Not securities (e.g., potentially BTC, ETH).

- Digital Collectibles: NFTs and gaming items (Not securities).

- Stablecoins: Regulated separately.

- Investment Contracts: Tokens that act like securities.

-

Implications: This framework aims to bring the regulatory clarity long sought by the industry. Furthermore, the Office of the Comptroller of the Currency (OCC) published Interpretive Letter 1186 on November 18, confirming that national banks have the authority to hold crypto assets for the purpose of paying network fees. While the market has largely ignored this news due to the overwhelming bearish sentiment, it lays the groundwork for institutional custody solutions that could facilitate the next bull run.

5.2 International Divergence: El Salvador vs. The World

While institutional investors in the U.S. and Europe are selling, El Salvador continues its solitary accumulation strategy. Despite the market crash, the nation purchased 1,091 BTC (approx. $100 million) on November 18, adhering to its “1 Bitcoin per day” policy. This aggressive buying stands in stark contrast to the selling pressure from German and U.S. government wallets earlier in the year, highlighting a geopolitical bifurcation in crypto strategy.

Meanwhile, Japan is moving to modernize its tax code. The tax agency has proposed shifting crypto taxation from a progressive rate (up to 55%) to a flat 20% tax rate, aligning it with traditional financial assets. If passed by the legislature later this year, this could unlock significant capital from Japanese retail investors, who have historically been major players in the crypto carry trade.

6. Sentiment Analysis: Parsing the Panic

Market psychology is currently residing in the depths of despair. The metrics suggest a level of fear usually reserved for systemic collapses, yet the structural integrity of the network remains intact.

6.1 The Fear & Greed Index

The Crypto Fear & Greed Index has plummeted to a score of 10/100, indicating “Extreme Fear”.

Table 2: Fear & Greed Index Trajectory (November 2025)

| Date | Score | Classification | Market Context |

| Nov 1-5 | 33-42 | Fear | Post-Shutdown Anxiety |

| Nov 10 | 26 | Fear | Tech Sell-off begins |

| Nov 14 | 10 | Extreme Fear | $90k Support Break |

| Nov 17 | 11 | Extreme Fear | Nvidia/Fed Jitters |

| Current | 10 | Extreme Fear | Capitulation Phase |

Historically, a score of 10 is a contrarian buy signal. It was last seen during the FTX collapse (Nov 2022) and the COVID-19 liquidity crunch (March 2020). In both instances, buying during this peak fear generated outsized returns within 6-12 months. However, the “catch a falling knife” risk remains high, as extreme fear can persist for weeks during a liquidation cascade.

6.2 The Retail vs. “Smartest Man” Divergence

The sentiment landscape is punctuated by bizarre divergences in expectations. On one side, retail sentiment is crushed, with search trends for “Bitcoin Crash” spiking and Nostradamus-style predictions of 2025 apocalypse circulating in tabloids. On the other side, high-profile, if eccentric, figures are calling for massive upside.

-

YoungHoon Kim’s Prediction: YoungHoon Kim, holding the record for the world’s highest IQ (276), has publicly predicted that Bitcoin will surge to $220,000 within the next 45 days, citing it as the “only hope for the future economy”.

-

Analysis: While such predictions are speculative and lack fundamental grounding, they highlight the extreme polarization in the market. The absence of a middle ground—moderate bullishness or moderate bearishness—suggests that the next move will be violent and likely fueled by a squeeze of whichever side is over-leveraged.

7. Forecast: November Month-End Scenarios

Based on the synthesis of the macro-liquidity vacuum, technical breakdown, and on-chain capitulation, we present three probability-weighted scenarios for Bitcoin’s closing price on November 30, 2025.

Scenario A: The Bearish Capitulation (Probability: 55%)

-

Catalysts: Nvidia earnings disappoint or guide flat, triggering a tech sell-off. The delayed Fed data (released Nov 20-26) shows hot inflation, killing December rate cut hopes. ETF outflows accelerate.

-

Price Path: Bitcoin fails to reclaim $94,000. The “Death Cross” attracts algorithmic short-selling. The price grinds down through the $83,000 support node, triggering a cascade of stop-losses from levered longs.

-

Projected Closing Range: $78,000 – $84,000

-

Rationale: The “DATCo” forced sellers and miner capitulation provide too much supply for the thinned order books to absorb. Tax-loss harvesting begins early.

Scenario B: The Stabilization and Rebound (Probability: 30%)

-

Catalysts: Nvidia beats earnings, stabilizing the risk-on narrative. Fed data comes in mixed, keeping the “soft landing” hope alive. Whales utilize the sub-$90k liquidity to re-accumulate.

-

Price Path: Bitcoin reclaims $94,000, invalidating the immediate breakdown. The market chops sideways in a range of $92k-$98k to digest the volatility.

-

Projected Closing Range: $92,000 – $96,000

-

Rationale: Historical data shows “Death Crosses” in this cycle are lagging; the worst is already priced in.

Scenario C: The V-Shape “Squeeze” (Probability: 15%)

-

Catalysts: A “shock” dovish signal from the Fed or a massive geopolitical de-escalation. A regulatory surprise (e.g., positive stablecoin legislation).

-

Price Path: A rapid surge back above $100,000 fueled by a short squeeze of late bears.

-

Projected Closing Range: $102,000 – $108,000

-

Rationale: Sentiment at 10/10 is unsustainable; markets tend to punish the majority. Analysts like DrBullZeus see a bounce to $107k as technically valid.

Consensus and Institutional Targets

-

Polymarket: The prediction markets are bearish, currently assigning a 77% probability that Bitcoin closes November below $90,000.

-

JPMorgan: Maintains a long-term bullish view but sees $94,000 as the production cost floor. They view the current price as undervalued relative to Gold.

-

CoinDCX: Forecasts a potential recovery to $114,500 by month-end, contingent on a liquidity reversal, but acknowledges the extreme fear makes this an outlier view.

8. Key Dates to Watch (Remaining November 2025)

The remainder of the month is a minefield of event risks. Traders must monitor these dates closely, as liquidity will be thin and volatility high.

Table 3: Critical Economic & Corporate Events

| Date | Event | Significance | Impact Potential |

| Nov 19 | Nvidia (NVDA) Earnings | AI Bubble test; Crypto correlation | High (Critical) |

| Nov 19-21 | Delayed Data (PPI/Jobs) | Backlog from shutdown released | High |

| Nov 20 | FOMC Minutes | Fed sentiment check | Medium |

| Nov 26 | GDP (2nd Est) & PCE | Fed’s preferred inflation gauge | High |

| Nov 28 | U.S. Thanksgiving | Market closure; Liquidity drain | Medium (Volatility) |

| Nov 30 | Monthly Close | Confirms monthly candle trend | High (Technical) |

Frequently Asked Questions (FAQs)

1. Is the Bitcoin Bull Market Officially Over?

While the market is in a “Deep Correction,” classifying the bull market as “over” is premature for long-term investors. Bitcoin is currently in a “Bear Trap” or mid-cycle correction phase, typical of the 4-year halving cycle. However, the loss of $90k and the “Death Cross” confirm that bears control the short-term trend. A weekly close below $83,000 would be the technical confirmation required to declare a cycle shift.

2. What is a “Death Cross” and why does it matter?

A Death Cross occurs when the 50-day moving average falls below the 200-day moving average. It technically signals that short-term momentum is deteriorating faster than the long-term trend. While it is a bearish signal, in Bitcoin’s volatile history, it has often been a “lagging” indicator—meaning the worst of the crash typically happens before the cross is confirmed on the chart. In the current 2023-2025 cycle, every previous death cross marked a local bottom.

3. Why is Nvidia’s earnings report affecting Bitcoin?

Bitcoin currently holds a high correlation (>80%) with the tech sector and AI stocks. Institutional investors treat both crypto and AI stocks as “risk-on” assets. If Nvidia crashes, it signals a retreat from risk, which usually triggers algorithms to sell Bitcoin. Conversely, if AI stocks boom, it could lift crypto, though it also risks siphoning liquidity away from digital assets toward AI equities.

4. Should I sell now that the Fear & Greed Index is at 10?

Historical data suggests that selling when the Fear & Greed Index is at “Extreme Fear” (below 20) is often financially unwise in the long run. Scores of 10-11 have historically marked cycle bottoms (e.g., 2022, late 2018). However, “catch a falling knife” risks remain high in the short term. Many analysts suggest waiting for a reclaim of support ($94k) or a stabilization at lower levels ($83k) before entry.

5. What are the “DATCos” and why are they selling?

“DATCos” stands for Digital Asset Treasury Companies—public firms that hold crypto on their balance sheets. Many of these firms borrowed money (via convertible notes) to buy Bitcoin. With prices falling, they are effectively “margin called” on their corporate debt covenants, forcing them to sell Bitcoin to raise cash and maintain solvency. This creates hidden selling pressure that isn’t immediately obvious to retail investors.

Conclusion: The Winter of Discontent or the Ultimate Opportunity?

November 2025 has served a harsh reality check to the crypto market, reminding investors that despite its maturation, Bitcoin remains a high-beta asset susceptible to global liquidity shocks. The convergence of the post-shutdown data vacuum, the unwinding of corporate leverage (DATCos), and the technical breakdown below $90,000 has created a “perfect storm” for bears. The immediate outlook is undeniably grim, with technicals pointing toward $83,000 or lower if the AI narrative falters.

However, for the astute observer, the underlying thesis for Bitcoin remains robust. The aggressive accumulation by El Salvador, the “Project Crypto” regulatory pivot in the U.S., and the historical tendency for “Death Crosses” to mark capitulation bottoms offer a counter-narrative. The current “Extreme Fear” reading of 10 serves as a powerful contrarian signal. While the remainder of November is likely to be fraught with volatility tied to Nvidia and the Fed, the $83,000 – $84,000 zone represents a generational line in the sand. Investors should remain vigilant, focusing on risk management and the preservation of capital, while keeping a close eye on the structural shifts that may very well plant the seeds for the next major ascent.

Disclaimer: This report is for informational purposes only and does not constitute financial advice. Cryptocurrency investments are highly volatile and carry a high level of risk. Readers should conduct their own due diligence.